center for responsible lending overdraft fees

Chase isnt responsible for and doesnt provide any products services or content at this third-party site or app except for products and services. Third there are some transactions that we cannot process automatically or until weve completed posting of your chronological transactions.

Grant In The Spotlight Center For Responsible Lending

The Extra Time clock will show you how much time you have left to bring your available balance to at least 0.

. 1 by clicking on any link to other Internet addresses you are leaving the credit unions web site. Checks drawn on Sams account will all process as if they occurred at 11 pm. The EUAC will use the credential to access the EUAC Center which enables the EUAC to submit Subscriber requests reset FedLine Subscriber passwords and access Subscriber reports and FedLine documentation.

Finally fees are assessed last. On August 24 2022 the White House announced a Student Debt Relief Plan that includes a one-time student loan debt relief targeted to low- and middle-income families. Is responsible for the content of the third-party sites hyperlinked from.

These banks overdraft fee reforms greatly benefit their customers Nadine Chabrier the Center for Responsible Lendings CRL senior policy counsel said in a statement. 5 SAVINGS WITHDRAWAL LIMIT FEE which is a Chase fee applies for each withdrawal or transfer out of a Chase savings account over six per monthly statement period maximum of three Savings Withdrawal Limit Fees per monthly statement period for a total of 15All withdrawals and transfers out of your personal savings account count toward this fee. Payday lending involves smalldollar highinterest loans that trap consumers into a longterm cycle of debt and fees.

Read through the article to learn more about overdraft fees how overdraft protection works as well as other terms that come up for overdraft fees and services. FedLine Advantage EUACs will also have access to the Connection Management Center CMC. If Sam had any Wire Overdraft or Return Item fees they would be sorted here based on the time they were processed by TD Bank.

However with weak underwriting and ability to repay standards the payday loan model creates a debt trap that is easy to get into but extremely difficult to escape. Rates as of 10162022. Youll have at least 24 hours to bring your available Spend account balance to at least 0 before you are charged overdraft fees.

3 the credit union is not responsible for the content of the alternate web site. If you sign on to Online Banking you can view the transactions that led to your overdraft by clicking on the Overdraft Item Fee or Returned Item NSF Fee. Physical check sent via courier to a third party on your behalf is 2000.

19 2022 PRNewswire -- KeyBank NYSE. Fees The following fees may be charged to your account. Accounts for spending planning and saving digital tools to help you manage your financial life.

A Cashiers check purchased online expedited delivery is 2000. Individuals with income less than 125000 and households with income less than 250000 will receive up to 10000 in debt relief and those who were Federal. 2 This service allows you to make Debit Card purchases or ATM withdrawals even if you dont have enough money in a particular account.

Return to footnote reference 1. Your account will automatically be reimbursed for all ATM fees charged by other institutions while using a Fidelity Debit Card linked to your Fidelity Cash Management Account at any ATM displaying the Visa Plus or Star logos. Fees may be charged for each Overdraft Item OD or Returned Item NSF.

Key Coverage Zone SM now helps clients avoid overdraft fees if theyre only overdrawn by 20 or less at the end of day as new terms begin. Are there other fees. Visit the Banking Education Center.

Please review its terms privacy and security policies to see how they apply to you. Optional Overdraft Coverage for Debit Cards 2 and ATM transactions. 4 the credit union does not represent either the third party or.

In early 2022 Citi announced significant changes to its overdraft practices including plans to eliminate consumer overdraft fees returned item fees and overdraft protection transfer fees. 0 overdraft fees if youre overdrawn by 50 or less at the end of the business day. Checking Plus variable rate line of credit cannot be linked to a checking account in the Access.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. When you opt-in to. At the same time.

More time to avoid fees. These changes will go into effect on June 19 2022. Welcome to the TD Bank Learning Center.

Chase Overdraft Assist helps you with. TD Overdraft Relief Find out. Check mark icon No overdraft fees 4 spend only what you have.

0 when you have any ONE of the following. Privacy and security policies to see how they apply to you. For questions or concerns.

Box availability and size vary per Experience Center location. Note that pending transactions will impact the available balance but wont incur any potential overdraft fees until after the items clear. Newest Home Lending stories.

Youll have extra time to fund your account when your available balance is negative before youre charged overdraft item fees. 0 overdraft fees if youre overdrawn by 50 or less at the end of the business day. A stop payment on a paper check or Bill Pay is 2500.

This program will run through December 31 2022. This includes Overdraft Protection transfers or transfers to maintain target balances in other accounts. Chase Overdraft Assist helps you with.

We subtract these remaining transactions in high to low dollar order. Payday lenders tout themselves as a needed service providing access to emergency credit. You also have the option of enrolling in Optional Overdraft Coverage for ATM transactions and everyday debit card purchases.

Visit to find educational tips and articles on everyday banking ways to pay lending and credit Finance 101 and more. But were not responsible for the content links or the privacy or security policies of this website. Now including Low Cash Mode An innovative game changing digital tool that can help you avoid overdraft fees with at least 24 hours Extra Time Payment Controls and Intelligent Alerts.

No more than 5 overdraft returned item fees per day will be charged to an account. 2 you are linking to an alternate web site not operated by the credit union. Chase isnt responsible for and doesnt provide.

0 overdraft fees if youre overdrawn by more than 50 at the end of the business day and you bring your account balance to overdrawn by 50 or less at the end of the next business day. The reimbursement will be credited to the account the same day the ATM fee is debited from the account. There were not enough funds in your account to pay for all of the transactions that were posted to your account.

A Cashiers check purchased at a Capital One location is 1000. 0 overdraft fees if youre overdrawn by more than 50 at the end of the business day and you bring your account balance to overdrawn by 50 or less at the end of the next business day. 1825 variable APR with the Citigold Account Package and the Citi Priority Account PackageIf you are in default your variable APR may increase by 200.

No minimum balance or monthly fees. Current variable Annual Percentage Rate APR. TD Overdraft Relief gives you flexibility and options to help avoid fees.

A balance at the beginning of each day of 300 or more in this account.

54 Overdraft Fee Photos And Premium High Res Pictures Getty Images

/cdn.vox-cdn.com/uploads/chorus_asset/file/22939018/GettyImages_1131510255_ext.jpg)

How To Protect Yourself From Overdraft Fees Vox

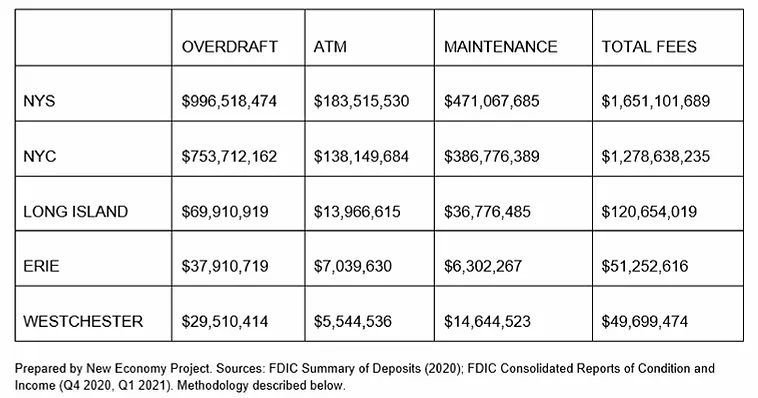

New Analysis Shows Banks Drained 1 7 Billion In Fees From New Yorkers Accounts During Pandemic New Economy Project

Mike Calhoun On Twitter People Who Are Most Frequently Charged Overdraft Are The People Who Can Least Afford It This Burden Falls Disproportionately On Low Income And Black And Latino Americans The High

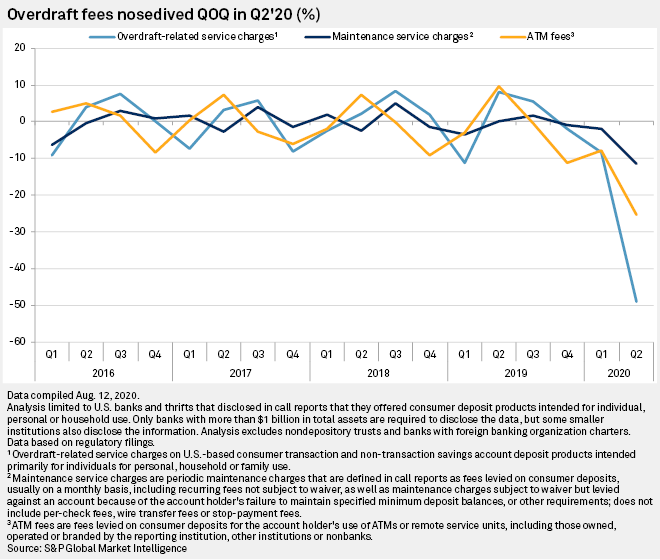

Overdraft Fees Plunge 49 Due To Covid 19 Shutdown S P Global Market Intelligence

Overdraft Fees Have Forced The Poor Out Of Banks Former Fdic Chair

Unfair Market The State Of High Cost Overdraft Practices In 2017 Center For Responsible Lending

Will Bank Overdraft Fees Spread Again Consumer Agency Is Reviewing The Rule The New York Times

Small Banks Face Bigger Threat To Overdraft Fees This Time Around American Banker

Bank Overdraft Fee Revenue Is On The Rise Frontier Group

Center For Responsible Lending Macarthur Foundation

Consumer Groups Press Agency To Support Reform Of Abusive Practices Fresh Today Cutoday Info Cu Today

No Fee Overdraft Has Saved You 100m Varo Bank

Bank Of America S Overdraft Fees Down 90 Under New Policy Abc News

The State Of Lending High Cost Overdraft Fees Center For Responsible Lending

The State Of Lending High Cost Overdraft Fees Center For Responsible Lending

Us Consumers Feel The Pain And Banks Feel The Profit Of Record Overdraft Fees Insider Intelligence Trends Forecasts Statistics

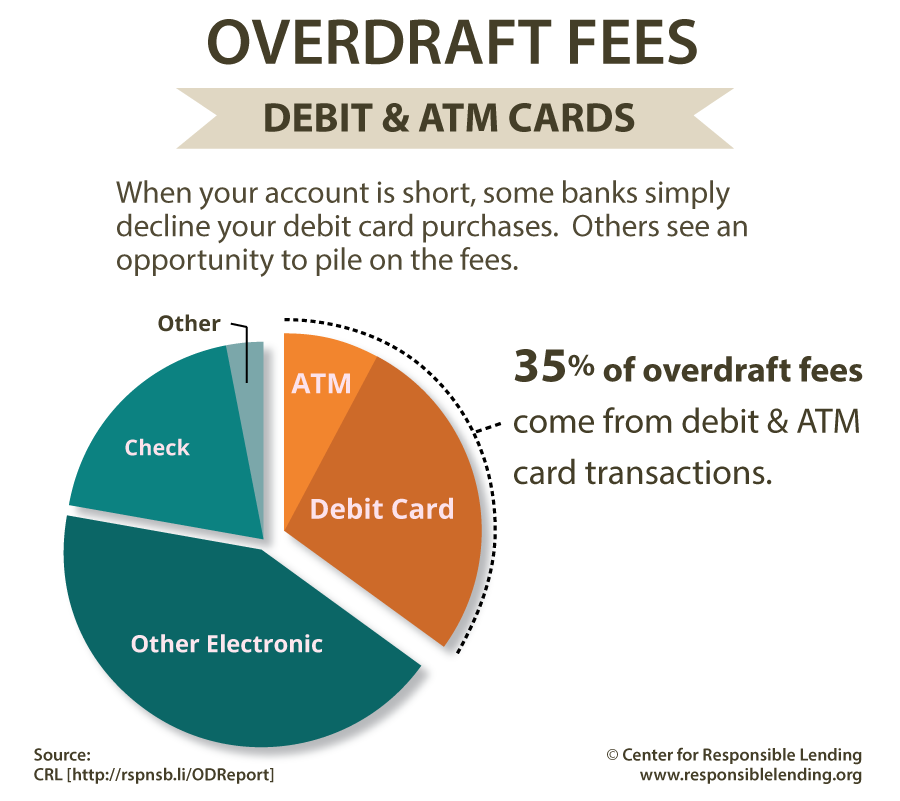

Abusive Overdraft Fees Drain Consumers Dry Center For Responsible Lending